Blog Detail

Why It's Still a Good Time to Buy a Home

August 31, 2022

Turn on the news, and you’re likely to see a story about the real estate market. The media’s pessimism surrounding the market has a lot of people thinking they should wait to buy a home, but that’s just not true. Despite the changes in the market, if you’re ready, now is still a good time to buy a home.

Appreciation

Homes are a good investment. In Southeastern Wisconsin, the appreciation rate averages 6.8% each year (Source: Metrostudy Public Record Data Analysis). If you’re buying a home that you’re going to live in for at least a few years, you can assume your home will appreciate, even if there is a flat or down year in the mix. Much like a traditional investment, the longer you keep your home, the more appreciation you’ll realize.

Inventory

With the continued lack of inventory, waiting to buy isn’t going to help you, and it could make it harder for you to find the home you want. There are not enough homes on the market to satisfy demand, and there’s no relief in sight. The Zonda Residential Economic Report shows that in 1990 the Greater Milwaukee real estate market produced about 8,000 new construction homes, single-family and multifamily combined. This year area builders are on pace to build under 3,000 new homes and stay at or below that number through 2026. The market will only get more competitive as more people look for homes.

Cost

If you want the lowest price on your new home, you should act sooner rather than later. As the cost of materials and labor continue to rise so do the prices of homes. The average price increase for new construction homes in our market is 5-10% each year (Source: Metrostudy Public Record Data Analysis). If you’re waiting for the cost of homes to go down, it’s not going to happen.

Mortgage Rates

With the recent moves by the Federal Reserve to curb inflation, mortgage rates have been on the rise. The average mortgage rate in July was 5.41% (WRA.org). Certainly, no one buying a home wants to see rates go up but look at the rates over time you’ll see they’re still low. The average mortgage rate over the last 30 years is 6.0%. So, despite the recent increases, mortgage rates are still below the historical average. And of course, if mortgage rates drop while you’re in your home, you can always consider a refinance.

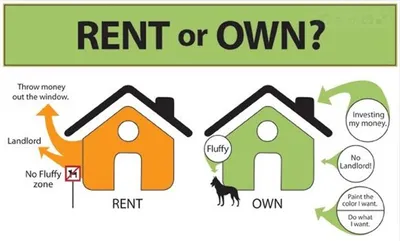

Rent

If you’re currently renting, you probably already know that the cost of rent has skyrocketed recently. Some communities in our market have seen up to a 20% increase in just the last few months alone. Rental prices are increasing at an accelerated rate as demand outpaces supply. While renting may have been a deal before, it’s become more expensive than owning a home in some instances, and at least with your home you own it and have the potential for tax benefits.

The market will always shift, so if you’re ready to buy a home - do it. There are certainly plenty of good reasons why now is still a good time to buy.

Latest Posts

March 1, 2023

Tour Condos During the MBA Spring Tour

November 22, 2022

A Return to Neutrals

July 19, 2022

Top 5 Reasons to Buy vs. Rent

June 7, 2022

Electrical Planning for Your New Home

January 21, 2022

Preparing To Downsize

August 31, 2021

New Home Tech Trends

June 24, 2021

Get Your Outdoor Space Ready for Summer

April 30, 2021

Kitchen Countertops: Choosing the Right Material

March 1, 2021

Spring Maintenance for Your Home

Previous Article

A Return to Neutrals

Next Article